Syndication is the pooling of investor money where the investor is typically a limited partner and the general partner, or active partner, puts the deal together and manages the business plan to provide a return for the benefit of all investors.

The Private Placement Memorandum is required by the SEC and describes the offering, risks, includes the partnership agreement, investment summary and subscription agreement. It is a lengthy legal document prepared by a syndication attorney. The subscription agreement section includes basic information as to amounts being purchased and percent ownership. The risk section highlights just about every possible risk that could happen.

Projected returns will vary by project. Calculating annual returns and the Internal Rate of Return (IRR) are two different methods that are commonly used to assess investment performance, each providing unique insights.

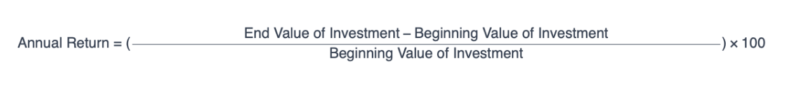

Annual Returns

Annual returns typically measure the percentage gain or loss of an investment over a one-year period. Here’s a basic formula to calculate annual returns:

This formula can be adjusted for investments held for more or less than a year.

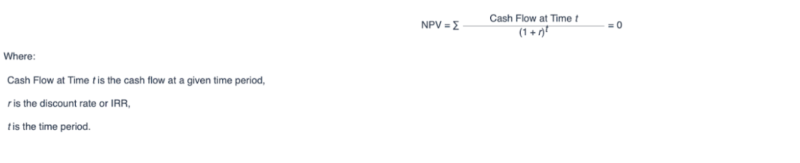

Internal Rate of Return (IRR)

IRR is a more complex calculation used in financial analysis to estimate the profitability of potential investments. It’s the discount rate that makes the net present value (NPV) of all cash flows (both positive and negative) from a particular project equal to zero. IRR calculations are typically done using financial calculators or spreadsheet software like Excel.

In Excel, you can use the IRR function to calculate it. You input a range of cash flows (including initial investment as a negative number) and the function returns the IRR based on those cash flows.

Keep in mind, while annual returns give a straightforward percentage of gain or loss over a year, IRR is more comprehensive, considering the time value of money and is commonly used for comparing the profitability of different investments.

Each project will vary. Many real estate investments are modeled with a typical 5 year hold period. This provides ample time to execute our value-add plan and then cash flow for a few years while looking for an opportunistic sale. Some investor principal could be returned as early as year 2 from a refinancing event or we may want to continue to cash flow till year 7, if the market is down in year 5. Other investments, such as a typical oil and gas investment, may have a much longer hold period (eg 20-25 years) with return of capital projected much earlier than a typical real estate investment.

Minimums vary from deal to deal but generally are set at $50K with preference given to investors with more to invest.

Investor distributions vary from deal to deal but most syndications make monthly or quarterly distributions.

We’ll provide monthly or quarterly email updates on the investment’s progress including renovation status/pictures, rents we are getting, and the distribution amount for the period. You will also receive a K-1 statement from us in March of each year for your tax filing.

One of our main goals at Diversified Investment Partners is to invest in opportunities that minimize tax burden and maximize tax incentives. Because our investment strategy focuses on diversification, the tax benefits of each project will vary, depending on asset class and deal structure. You may want to consult your CPA or financial advisor about the tax benefits of a particular opportunity.

Yes – We model different scenarios to show our breakeven point for profitability given a decline in occupancy or if rents drop below projections.

Yes – You can invest in real estate and other types of syndications with certain retirement accounts. We are happy to discuss how to boost your IRA investing returns with real asset investing.

The returns forecasted are described in the private placement memorandum (PPM) and vary from deal to deal. The most common fee is an acquisition fee based on purchase price and is paid at closing. This covers the general partner’s costs to find the deal and get it under contract. The second most common fee is the asset management fee which is compensation for holding the property manager accountable, to ensure execution of the business plan, bookkeeping, and distribution of checks and K1s. The asset management fee is aligned with the investor’s interest as it is based on the property’s revenues. Industry averages are 1-3 % for both fees.